“Life is really simple, but we insist on making it complicated”. Confucius.

“There is no investment so good that there isn’t a fee large enough to kill it”. – Cliff Asness (AQR Capital Management).

Fund flows are a well-established method of watching for trends in investment strategies. They tell us what the majority are thinking (or not thinking) at any given time. They normally arrive with a lag of several weeks or even months, so it is dangerous to use them for timing purposes, but they give a good steer on investment sentiment, particularly within Institutional investors.

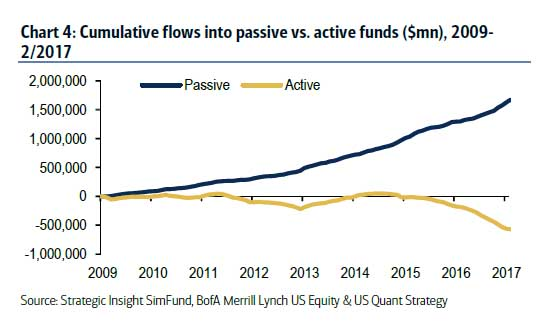

However, the main trend in fund flows over the past 10 years has been one of movement of money from Active to Passive management, (which is essentially an intra-market flow, since money does not leave equities, or bonds etc, but merely redistributes it within the industry). Morningstar recently (see here) updated the numbers for 2016, which showed that if anything, the tide is accelerating in the direction of Passive.

It is not just pure Active managers that are feeling the pain, however: as part of a long-running review, Blackrock announced this week that it was to “reorganise ” its’ Actively managed equity business, which will involve the redundancy of several Portfolio managers and dozens of other employees, to be replaced by this….

They will not be the last. Low returns and a new appreciation of the costs of Active management has led to a wholesale shift in Investor preferences; if $5 trillion in assets is not sufficient protection from these trends, smaller firms are going to have to bail like crazy just to stay afloat- most will end up sinking.

Of course, outsourcing one’s investment policies to robots, who have never seen a rate hike cycle, Central Bank balance sheet contraction or anything more than a 10% market correction entails further risks. For example, if the machines decide to sell (I know this seems fanciful, but bear with me), it is likely to be the result of the same signal that will prompt all the other robots to do the same, leaving the question of to whom do they sell? That is a question for another day, however, as the survival of Active managers is at stake (for them), and they seem to be losing the Darwinian struggle.

Looking at the Morning Star data in detail, what is particularly striking is the uniformity of the moves, (see the first chart), as if all investors have come to the same conclusion at the same time. In 2016, the S&P 500 saw a net 12% gain, which would normally inspire new money into markets, but the NET yearly flow between US Equity, Sector Equity (which is a proxy for ETF’s) and International Equity was just (I use that term loosely), $18 billion in favour of Indexing, so investors have not got more bullish per se, but have just changed their strategy. As Morning Star comments, US (Active) equity funds have not seen a net inflow for 12 years! The only divergence from this trend is in Taxable/Municipal bonds, but this may have more to do with tax planning than Investment strategy and even then, Passive flows dominated.

The end of the year saw a swing towards equity versus bonds, as Trump’s reflation plans implied higher inflation/interest rates etc. but that has seen little follow-through, in price terms at least, with 10-year Treasury yields more or less where they finished November 2016 at present (31/3/17). We may also be witnessing the beginning of the end (see page 5 of the pdf) for “Alternative” funds (Hedge funds, which recently have become an alternative to making money!) Another high profile closure and the accelerating pace of liquidations in the past year saw inflows dwindle, returns lag behind the Indices and many of the former “Smartest guys in the room” simply give up.

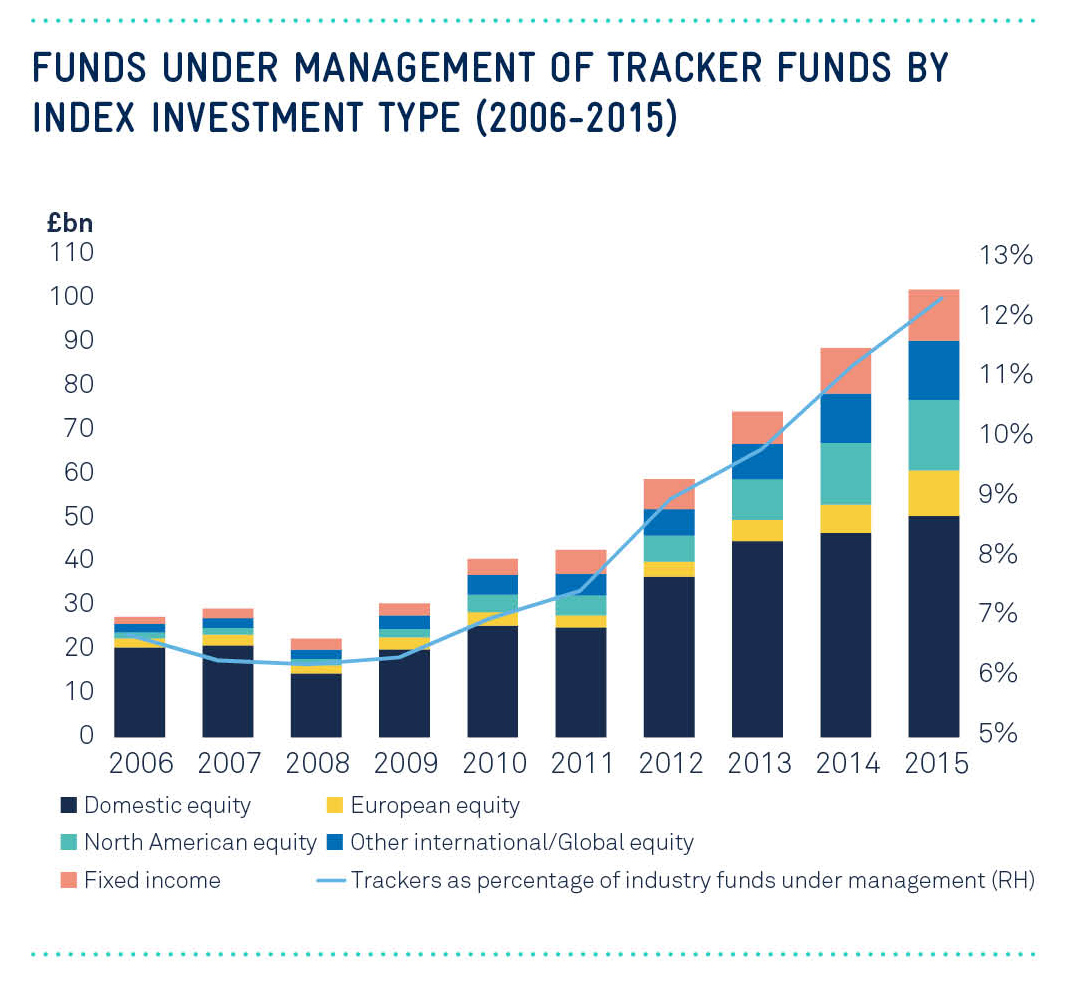

Lest this post be accused of being US-centric, the following chart tells the same story in the UK, albeit from a lower base. Figures for 2016 do not seem to be available yet, but it would be a major surprise if the US trend was not being replicated here- after all, UK investors have the same issues of cost and performance as their transatlantic cousins. What occurs in the US is often mirrored over the pond…

Here at EBI, we take (only a) little pleasure in watching these developments unfold- there will come a time, for now, seemingly in the indefinite future, when the last Indexing “believer” will have bought, leaving the strategy bereft of new buyers, leading to its ultimate demise, But that currently looks a distant prospect; so for Active managers, the pain will go on. Something WILL change (it always does), but for now, Passive’s victory is looking increasingly complete (see the second chart in the pdf). It is gratifying to seem to be on the right side of history, but we cannot be complacent- as always, we will strive to follow the evidence, wherever it takes us. As Keynes once said, “when the evidence changes I change my mind- what do you do ?”