“The difficulty lies not so much in developing new ideas as in escaping from old ones.” – John Maynard Keynes

The next few months are shaping up to be a clash between the “Establishment” and the “Outsiders”. In June, the UK’s European Referendum takes place; there are important regional elections in Germany, with Angela Merkel under pressure over the migration problem, and it all culminates in the US Presidential election in November. We already have a good idea of how they will be played- the Scottish Referendum was dominated by the “fear factor”, and this is a feature of the “Brexit” campaign already. Kim Il Cameron has now raised the possibility of War if we leave the EU, raising the bar for levels of ludicrousness beyond the point of parody. The newest member of the MPC (Monetary Policy Committee) has said that UK Interest Rates will rise to 3.5% if we “Brexit” (1). The Daily Mash has taken the meme to the logical conclusion..

On April 6th, the Dutch rejected an EU free trade deal with Ukraine in a referendum: coming after the commencement of the campaign in the UK, the EU has responded by suggesting that “it is time for a ban on referenda”.

Political crises in Brazil, Turkey and Austria have erupted more or less at the same time, and things appear to be afoot once again in Greece , as the (un-elected) Troika seeks to impose yet more cuts on the Greek population. It appears that there is a significant dis-connect between the Rulers and the Ruled, which is recognisable globally.

Meanwhile, in the US Presidential election, the ultimate insider, Hilary Clinton is facing a spirited challenge from both Bernie Sanders from the Left, and Donald Trump on the right. Both reflect, (in completely different ways), widespread dissatisfaction with the current political class. The Republican establishment have gone from dismissing Trump, to laughing at him, to fearing him in a matter of months. He does not need them, (after all he is a billionaire), which means a loss of power and relevance for them in the event of his victory- the irony of Billionaire ousting the Billionaire class from power cannot but be enjoyed. There has been speculation recently that the Republican insiders will try to de-rail his challenge by fixing the Convention voting process to ensure that he cannot gain the nomination. Whether that merely fans the flames of discontent, is an open question.

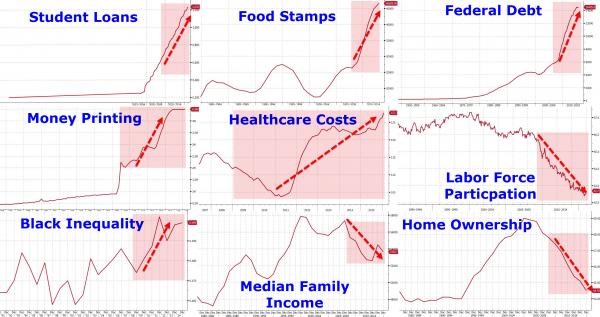

The Fed is not immune to this phenomenon: Janet Yellen recently felt compelled to re-iterate that they (the Central Bank) “are focused on Main Street, on supporting economic conditions – plentiful jobs and stable prices – that help all Americans.” An odd thing to say, one might think, in that it should be self evidently true. That she felt the need to say it only serves to undermine it’s veracity; the $4.5 trillion in Bank bail-outs, QE and so on have yielded the following results:

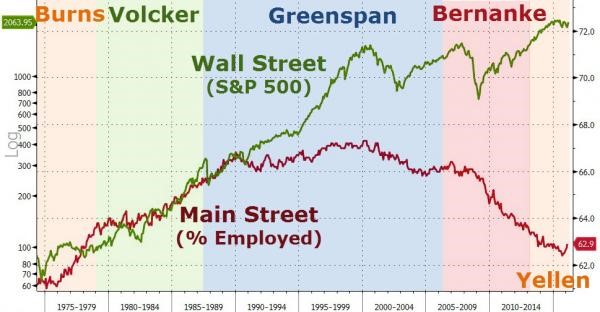

Pushing the cost of capital to the lowest in decades has caused textbook academic theory to break down. The “recovery” has been entirely felt by Wall Street.

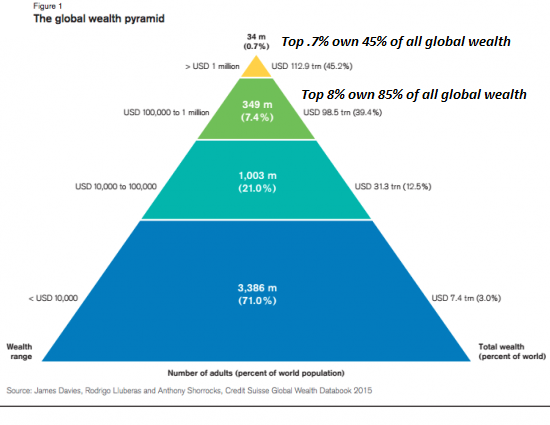

Why do “Elites”(2) hate change ? The chart below sums it up nicely.

Nevertheless, change appears to be in the air. The anger at the collusion of Big Business and Government “against” the rest of the population in areas such as expense claims, tax avoidance and police brutality is tailor -made for the likes of Trump and Sanders in the US, and the likes of Farage and Boris Johnson in the UK. The outsiders may not win in the US this time around, and the BREXIT campaign may fail, but they will be back: the genie is now out of the bottle. We may be entering a new period of political change, and it is likely to get messy, not to mention volatile- the longer the establishment resists these trends the messier it will get.

It is said that it is not difficult to escape quicksand as long as one doesn’t struggle too much (- not sure they had too many volunteers to test that theory !); so it is in investment. The likelihood is of increasing volatility in markets as these factors play out. But the key is not to struggle (i.e. trade) too much; find a risk level one is happy with and stick to it. Things change, sometimes quickly, but they are by their nature impossible to predict. It is however important to be aware of the possibilities, to better align portfolios with risk tolerance. Forewarned is forearmed !

(1) Let us consider this scenario: in a World of Global currency wars, the Bank of England is going to raise Interest rates by 7 times to prevent a collapse in Sterling- most Central Banks are aiming for currency depreciation- what would be the likely effect of all that inflation caused by Sterling’s collapse ? A demand strike, as consumers would be unwilling or unable to pay the higher prices- to raise rates by 3 percentage points would therefore be an act of economic vandalism and would lead straight back to the economic malaise we are currently in (or worse). Either the economist quoted is hopelessly misinformed, or he has an agenda. I couldn’t possibly comment..

(2) In this context, the elite is not just Bankers, Politicians etc. It can be anyone who is benefiting from the Status Quo (the Media, the Military and so on). Tom Hanks has recently informed us that “America IS great” already, and thus has no need for Donald Trump. It is much easier to enthuse about America’s “Greatness” if one has annual average earnings of $26 million- it may not be so good for the 45 million Americans currently on Food Stamps. This merely reveals how breath-takingly out of touch the elites truly are.