A couple of weeks ago we looked at the European interest rate situation in the context of the Fed’s dilemma over Interest Rates. Today, we look at one of the consequences of these super-low rates, as a result of the efforts to avoid currency appreciation: house price appreciation.

On the 4th December the ECB will announce what they intend to do about the seemingly intractable problem of low inflation. Mario Draghi said, in a speech recently that the ECB will “do what they must”, to raise inflation (or at least expectations thereof). But the real story is elsewhere in Europe, namely in Sweden, Denmark and Switzerland, which, though not in the Euro, are watching closely, not least because they are directly in the firing line. A cut in Euro interest rates will force them to respond to prevent their currencies rising anew, and a further deflationary impulse being transmitted throughout their economies. Sweden recently announced a further expansion of their QE programme by SK65 billion (£5 billion at current exchange rates), and the Swiss have seen the first bank pay negative interest rates on retail deposits this month. In Denmark, negative interest mortgage are already here.

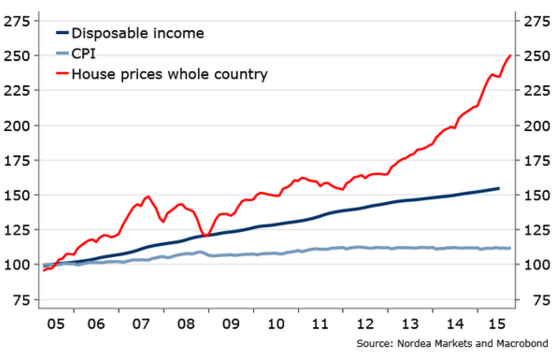

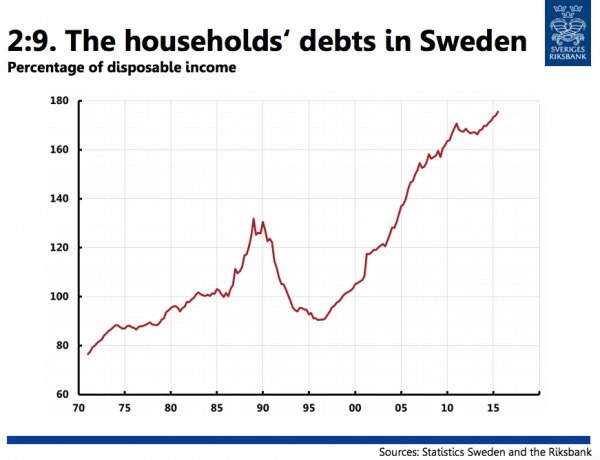

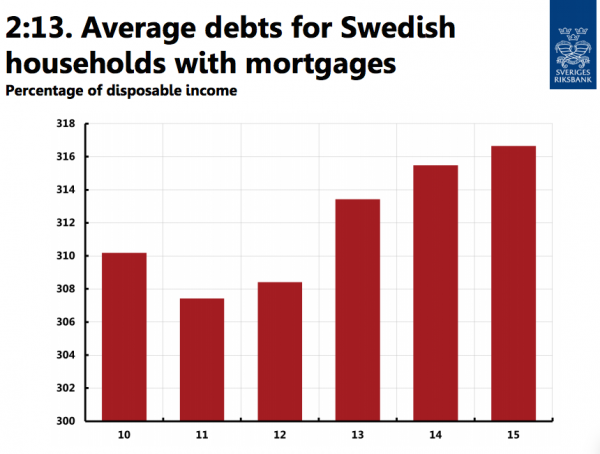

The Swedish Central Bank in particular is not happy. In a Report published on Wednesday this week, they warned “Low interest rates contribute to the trends of rising house prices and increasing indebtedness in the Swedish household sector continuing. Current debt levels already pose a substantial risk to the Swedish economy. It is thus essential that the Riksdag (the Swedish parliament), the Government and other authorities implement measures to reduce this risk. If no measures are taken, this, in combination with the low level of interest rates, will further increase the risks, which may ultimately be very costly for the economy.” (Stefan Ingves, Riksbank). The charts below highlight the extent of the problem.

These low interest rates, are, of course, the purview of the Riksbank. They could stop the competitive interest rate cuts, (the Repo rate is currently -0.35%) which would slow down the growth of house prices, but they won’t, because they are terrified of the economic consequences of so doing. So they look to “other authorities” to do the dirty work, which of course means no-one will actually do anything. A similar pattern is occurring in Denmark, Switzerland , and Norway, which to UK reader’s eyes, may look familiar…

We know that that which is un-sustainable will not be sustained, but many people (this observer included), have been expecting a house price collapse for as long as I can remember, which has stubbornly refused to come to pass. These things can (indeed must) go on longer than most expect (see our previous post to see how this process works) but it will not be pretty when it all comes to an end. It al looks like a bubble in search of a pin.

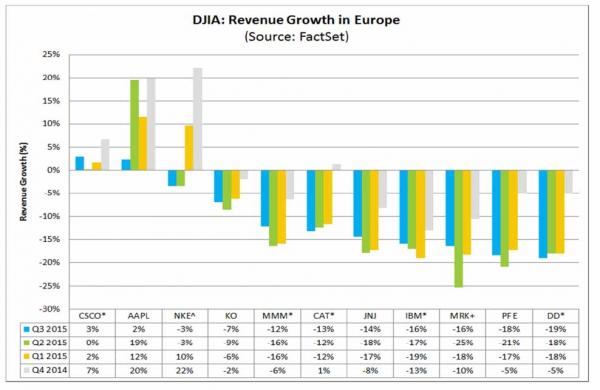

Of course , the effect of the weakening of European currencies is also felt in US Corporate performance, as the weaker Euro translates into lower sales when re-priced into US Dollars. Since April 2014, the Euro has fallen 23% which reduces the repatriated profit by 23% simply due to the translation effect, ignoring any negative profit margin effects. US Companies derive 40% or more of their sales, (and 50% or more of their profits), from overseas. US firms are increasingly citing the strong Dollar as a factor in their earnings announcements. Of course, there are a large amount of Asian companies that are in a similar situation, though in reverse. They now have to earn the Euro equivalent of 0.94 to pay $1 in debt interest and Principal ,whereas it used to require only E0.74 for the same purpose 18 months ago.

Factset sets out the gory details: “Overall, 11 of the 30 companies in the DJIA (the Dow Jones Industrial Average) provided revenue growth numbers for Europe for the third quarter. Of these eleven companies, nine reported a year-over-year decline in revenues”. The chart below shows the damage, and it appears to be getting worse. One of them MMM, reported that “Foreign exchange impacts reduced sales by 7.4 percentage points, with notable year-on-year declines in the euro, yen, and Brazilian real. These currencies devalued versus the U.S. dollar by 15%, 14%, and 37% respectively.” –3M (October 22).

The Atlanta Fed has a real-time GDP Model which is now running at 1.8%, compared to consensus forecasts that currently sit at 2.7%. Assuming 1.8% for Q4 that translates into 2.1% for 2015, well below 2.4% in 2014. This then brings us back to the Fed, and the December “decision”. Once again, Janet Yellen will have to weigh the need for interest rate “normalisation” against the interests of Corporate America .

In the shorter term, the focus is on the ECB. How they choose to act will define the next few months. They have an almost impossible task, with huge dangers and no simple solution. For the media this is manna from heaven, with plenty of scope for hyperbole, speculation and rumour. For investors, the task is easier – don’t just do something; stand there.