“If you gaze long enough into an abyss, the abyss will gaze back into you” – Friedrich Nietzsche.

Amidst the sound and fury of trade war rhetoric, there are signs of problems in the banking system in China. In the last 3 months, there has been a spate of previously unknown events there – bank defaults. This week’s news of a delay in the implementation of (some of) the US tariffs on Chinese goods led to an immediate spike higher in shares (and lower in bonds) but has not changed the situation that has plagued the Chinese banks.

China has a long history of rescuing corporate (non-bank) entities in the event of distress; in the period between 2015 and 2017, the Chinese Central Bank orchestrated 7 bailouts (or “re-structurings”, as they prefer to call them). What appears to have changed is that the slowing economy has increased the number of bad loans, meaning that banks are now suffering dwindling reserves as investors refuse to lend them any more capital. In this instance, bank creditors, previously assumed to be protected got hurt as the State took the bank over. Recovery rates (i.e. the amount that investors in the banks Certificates of Deposit and other liability issuances of Baoshang Bank actually get back) were to be between 70 and 80% of the initial investment (except for small savers, who were made whole by the government). This caused a freeze in the banking system and a sharp rise in interest rates, as investors became much more cautious across the board about investing in Chinese bank debt of all kinds, which prompted a volte-face by the authorities. They facilitated nearly full re-payment (99.98% according to news reports) of creditors, but the damage to investor confidence/complacency was done.

Then, at the end of July, another bank met with regulators to discuss “liquidity problems”. This time, Bank of Jinzhou, with $100 billion in assets (and which featured at #2 on Barclays Bank list of those whose 2018 annual reports had been delayed, potentially signaling liquidity problems) was effectively nationalised, as state-owned banking system actors bought the firm outright.

Bailout #3 occurred at the beginning of August, as Heng Feng Bank (at the top of Barclays list above), was the recipient of a “strategic investment” by a subsidiary of China Investment Corporation (the government’s proxy shareholder in the nations four largest banks). This time, the bank has $200 billion in assets, marking another step up in state intervention to backstop the banking system.

China appears to be having difficulty avoiding bank bailouts (not that the West is in any way immune from this!), possibly due to fears of the alternatives. Nearly all forms of debt (State, corporate and individual) are at record levels and are proving hard to address without further compounding the moral hazard problem. Markets now seem to fear that larger banks will be “invited” to bail out their smaller brethren, thereby contaminating their own balance sheets in turn (in the same way as the purchase of HBOS by Lloyds Bank in 2008, led to the latter being forced to turn to the UK government for a bailout as the purchase undermined the latter’s financial solvency).

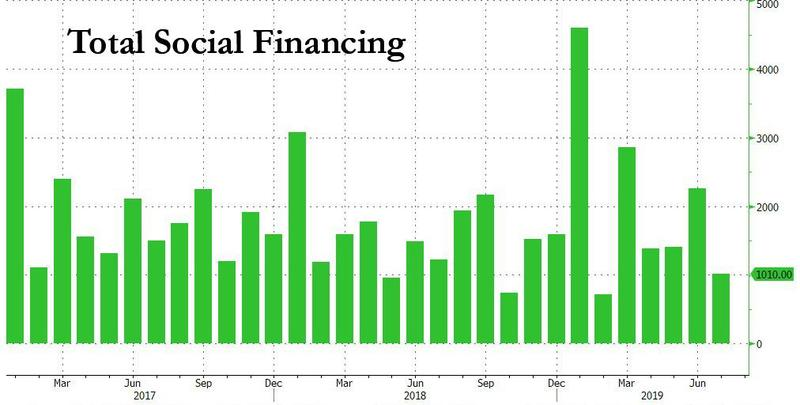

A slowdown in economic growth appears to be in motion – July’s Total Social Financing (a measure of the total amount lent by the Chinese financial system to the real economy) appears to be slowing, as Banks (and non-bank actors) seem to be reining in their lending.

But how is this different from what is going on in the West? Yield curves are flattening in every developed bond market, with both the UK and the US 10 year bonds now offering less return than their 2 year equivalents. If Trump believes that he is “winning” the global trade war, he might ask why bond markets so profoundly disagree with this assessment, though of course, he won’t. For every poor piece of economic data out of China, there is an equivalent one in the West and in a globalised, mutually dependant world that is an inevitability. Nowhere is immune to these pressures, which is presumably why investors are prepared to buy bonds that yield either nothing (or less than that).

All this comes at an inconvenient moment as the MSCI has raised its “inclusion factor” (the proportion of a stock’s free-float capitalisation that is included in the MSCI Indices), from 10% to 15% at the end of this month. This could lead to around $22 billion of new money into the MSCI Emerging Markets Index as the country’s weight rises to 2.46%. (It will be raised again in November as well). Non-passive investors will have to make an important decision, as, by not including Chinese shares in their portfolios they will be taking a significant (negative) “view” on China – what they decide will increasingly determine their relative investment performance – for Index investors, this is not a decision at all.

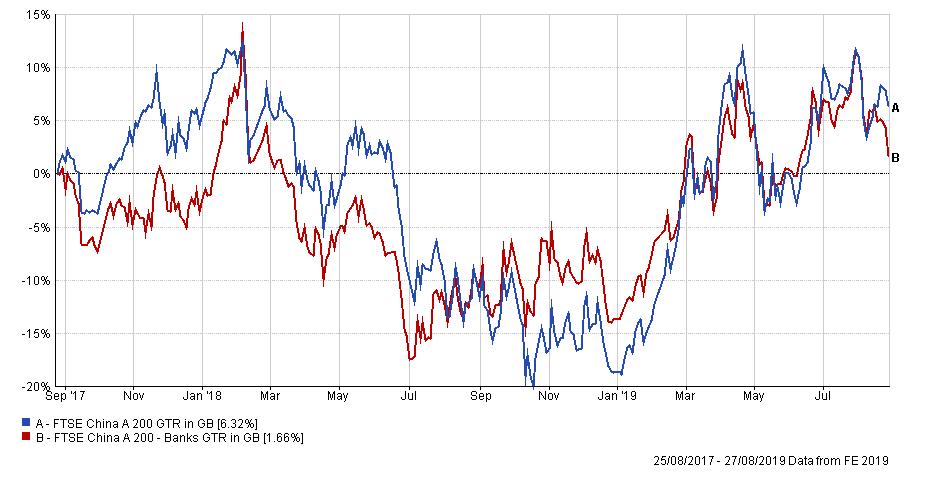

As the chart below highlights, investors have not seemed too phased by all of the news coming out of the Chinese financial system, admittedly in what has been a strong market so far in 2019. The first step in the MSCI re-weighting process began in May of this year (which has been replicated by the FTSE Russell Indices) and neatly coincides with banks starting to outperform the overall market [1].

All this is a reminder that return has a price-risk. There is a reason that Emerging markets have a better yield and are cheaper (in Price/Earnings ratio terms at least) than developed world markets. They embed more risk and so the only way to mitigate that risk is to allocate investment capital in accordance with investor risk capacity/tolerance.

EBI Global 60 to take an example, has primary exposure to Chinese equities through the Vanguard EM Index fund, the Dimensional Value fund, and the DFA Targeted Value (small cap) fund, representing 3.6%, 4.6%, and 2.2% respectively (as of the end of July). The Chinese equity content of the three is 31.6% (EM Index), 17.13% (Value) and 16.99% (EM Targeted Value). By multiplying the first percentage by the second, we can ascertain the overall percentage of exposure to China [2]. The total is 2.29% – is this too much (or too little)? We don’t know, but even if China DOES implode, it is not going to have a substantial impact on portfolio return. The converse is also true, but outperformance will inevitably lead to a higher exposure, thus ensuring that the funds increasingly see the benefit of price gains. As we don’t know what will transpire, this is the best way to deal with the issue – leave it in the hands of the marketplace.

[1] FE does not have data for MSCI equivalent Indices, but they will not likely be that different as they are both subject to the same fund flow pressures.

[2] For example, the EM Index fund weighting to China is thus 31.6% (China weight in the benchmark) by 3.6% (fund weighting in the EBI Global 60 portfolio), which is therefore 31.6 x 0.036 = 1.14 percentage points of allocation. Doing the same calculation gives us a Chinese weighting of 0.78% for the value fund and 0.37% for the Targeted Value fund. This totals 2.29%, which is below that of the MSCI Index weighting at present, due to China’s underperformance vis-a-vis the FTSE All-World Index.