“Know what you own, and know why you own it.” – Peter Lynch

There appears to be a battle of wills going on between the Federal Reserve and the markets at present; each time the Fed raises rates, citing the strength of the economy, falls in unemployment or the continued rise of stock markets as a reason for so doing, the yield curve flattens. This is not supposed to happen. A rise in interest rates should cause the yield curve to steepen [1], as markets price in further rises, as a consequence of economic improvement. But, as the charts below (from ZeroHedge.com) demonstrate, the Bond market is dissenting, essentially telling the Fed that they have gone too far (already) and that a recession is imminent. This has not just been the case in the days since the last rate increase, but a recurring theme of the last 6 months. It is by no means a purely US phenomenon either.

.png)

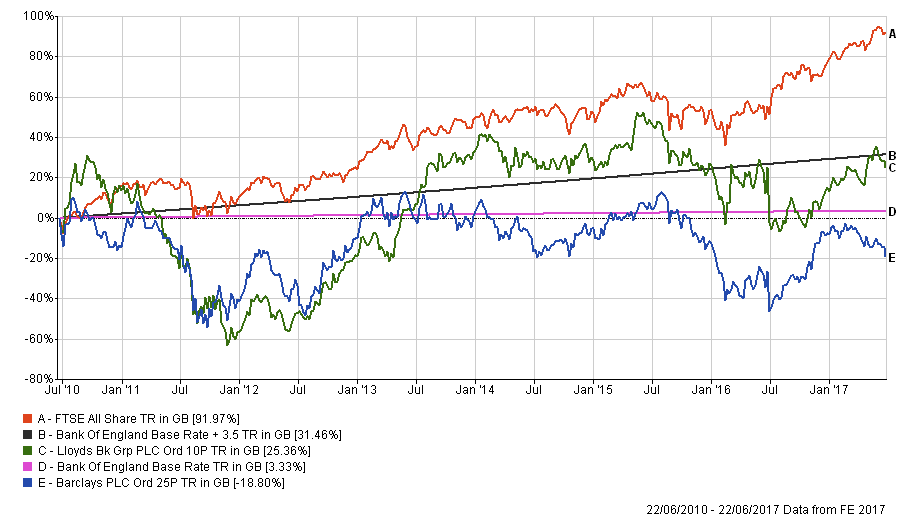

Lower interest rates are great news for everyone right? Er, no. Banks for example don’t like it one bit, because it reduces their NIMs (or Net Interest Margins). Studies appear to confirm what is intuitive, namely that if Banks are borrowing short term funds (via deposits etc,) and lending long term (to businesses or homeowners), the difference (or spread in the jargon) will to a large extent, determine their profitability. Of course, there are other factors – in a low interest rate environment, bad debts will be lower and if Banks decide to buy stocks/bonds etc. these will presumably be profitable, but overall the effect appears to be negative. The chart below shows the woeful performance of UK bank share prices since 2010, which appears to confirm our observation (here), that for a while at least, Banks may well be a Value trap. The fact that neither Barclays nor Lloyd’s have beaten the UK Base Rate +3.5% over 7 years is not an encouraging sign for putative buyers.

This may well have come as a bit of shock, especially to all those who were predicting a bond bloodbath once the Fed dared to raise rates and were advising all and sundry to sell bonds at the first available opportunity. As we have emphatically warned, western economies cannot withstand higher interest rates, as debts remain far too high; the predictions of gloom for Bonds have failed to take into account second-order effects [2] of the rate increases that these pundits expect, leaving them once again confounded. Whilst not expecting an “Ice Age”, we could continue to point investors away from the idea that Interest rate rises automatically lead to bond price falls, or that investors should anticipate a collapse in fixed income securities. Alarmed by media hype, many investors have sold bonds only to discover that Armageddon has failed to arrive, leaving them wondering whether (or if) to get back in. No doubt, the same media will soon be telling us that rates won’t be going up anytime soon (though rather too late in the day to help much!).

At EBI, we have always advocated bonds as a defense against market volatility rather than as a source of return; their purpose is to dampen return volatility arising from exposure to equities, so to an extent the possibility of “collapse” is irrelevant, as it would likely be accompanied by a significant rise in share prices. To abandon bonds would to an extent require us to reduce equity exposure, which defeats the long-term benefits of investing in the first place, since the latter is the primary source of returns.

It is certainly the case that some appear to be over-thinking these events ( which is something that few of us at EBI could ever be accused of). Whether or not the flattening yield curve portends recession (or anything at all), is really a matter for bond traders, (since it is impossible for Investors to directly act upon it, even if they wanted to). We will continue to stick with bonds, for the reasons elucidated above. Our Duration targets remains c.4-5 years, concentrated on high-quality bonds, which means that we have some protection from price declines in any event. Doing much more than that often creates more problems than it solves…

[1] Since these charts measure the yield difference between two different maturity bonds, a curve steepening would mean that the difference between the two yields widens. A flattening of the curve (as is occurring now), would mean the opposite-that yield differences are narrowing. This means that investors are prepared to accept relatively less over time for increasing their bonds’ maturity risk. A flatter yield curve, therefore, points towards expectations of recession ahead, which generally reduces the interest rate required by Investors.

[2] A rise in interest rates means debts are harder to service. As a result, either spending falls, or bad debts rise. Either way, the slowdown in the economy would push interest rates back down again, implying rises in bond prices again. This negative feedback loop not likely to end in the continued existence of excessive debt burdens.