“You expect me to talk Goldfinger?’

“No, Mr Bond, I expect you to die” Goldfinger, 1964.

The election of Donald Trump has led to a sharp sell-off in Global Bond prices (and thus a rise in interest rates). Needless to say, analysts missed it (see this Bloomberg article), but we’ve been there many times before. A combination of speculation regarding Janet Yellens’s future at the Fed (which may mean an end to QE), and the government spending implications of Trump’s infrastructure expenditure plans, has led to a big jump in yields (reward-free risk has arrived!) and thus a similar fall in prices. The pain has been widespread, but the long end of the (European) bond market, “massively over-subscribed” just a few short months ago, has seen more than its share of the damage. In total, more than $1 trillion in market value has been lost in the week since Trumps’ victory alone [1].

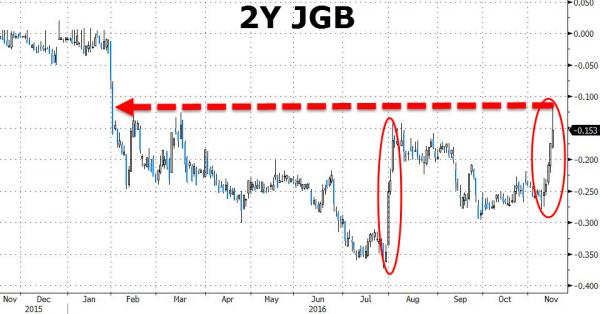

US bonds have not been immune. In turn, the interest rate premium for Treasuries versus Japanese bonds rose sharply, (see below) prompting selling of JGB’s, pushing their yields to above zero for the first time since March 2016. Meanwhile, shorter dated JGB’s are seeing even larger falls, leaving the Yield curve flatter, the exact opposite of the Central Bank’s stated aim of steepening the curve.

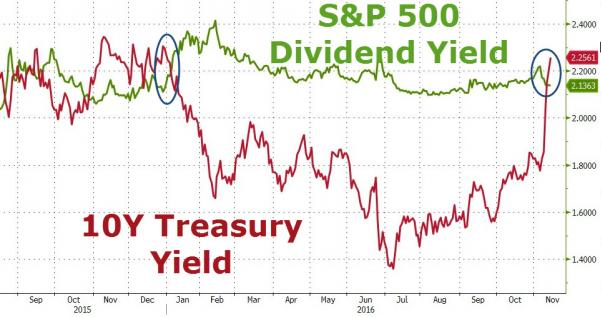

As a result of the surge in bond yields – up 0.4% in a week – combined with a further rise in equity markets, the former’s yield is now higher than the latter’s’, for the first time in more than a year. This implies that bonds are now relatively cheap compared to equities [2].

There is a temptation to take this weeks’ events at face value and extrapolate them into the future (as a few are already doing), but some second-order thinking may be appropriate here; higher interest rates have a chilling effect on investments, especially in a world awash in debt, and where consumer psychology is in no mood to stomach higher prices. (Tesco’s “marmite war” with Unilever, whilst obviously self-serving, put the latter on the back foot from the start, and may well serve as a warning to others against the PR costs associated with raising consumers’ bills). The “Aldi effect” is still a potent force and will not be swept away quickly.

If consumers could reasonably expect real pay growth, it might be that they would be willing to spend more but this is not happening for a variety of reasons. The first casualty is likely to be the housing market, and this is already starting to become apparent – US Mortgage applications in the week to 11/11/16 (i.e. before the full Trump effect took hold), fell to the lowest level since January.

The rise in the Dollar Index (+4.5% in a week) has put a lot of pressure on Emerging Markets currencies (and stock markets) as they have heavy dollar bond liabilities, which now must be repaid in more expensive dollars. The rise in the dollar also reduces the value of US overseas earnings, meaning US multinationals are hurt in valuation terms.

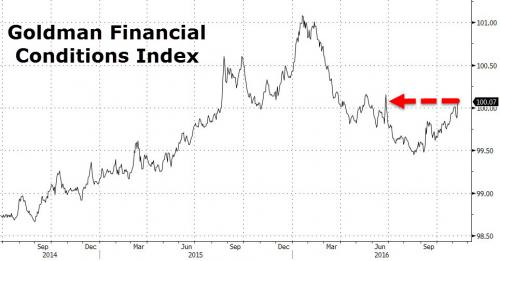

As the chart below demonstrates, the economy has already seen a +0.57% effective interest rate rise, and another +0.25%, widely expected in December’s Fed policy meeting, would add further to the pressures. Tighter financial conditions are associated with a reduction in the flow of money through the system, in the process hitting asset prices, which then exerts downward pressure on the economy. The Fed has demonstrated an extreme reluctance to raise Interest rates, apparently terrified of the market’s response; global equity valuations are predicated on low interest rates, and a sustained rise in rates threatens to undo the ONLY thing that Fed policy has actually achieved – rising share prices. If the Fed does raise rates, and the markets fall sharply, we could even be back in QE4 territory!

There is an old commodity adage that states “the best cure for low oil prices is low oil prices”. In the same vein, higher prices will inevitably depress demand sufficiently to dampen any inflationary effects. If so, inflation is going to be a temporary and self-correcting phenomenon.

Our EBI 70 portfolio (see here – login required), is experiencing substantial bond under-performance for all the reasons stated above. But the jury is very much out on the fate of the bond markets in general. Call us contrarians, but just as the world was giving up on Emerging Markets in August 2015, we re balanced our portfolios to raise our exposure in that region. The sentiment towards bonds appears to be darkening in a similar fashion, and although bond price falls will not directly trigger a re-balance, (since the inflection point is determined by the relative performance of the equity components of the portfolio), if bond prices sink further, it increases the likelihood thereof, in which case we would be certainly increasing our bond exposure. It will probably feel lonely to do so, but experience tells us that the most “uncomfortable” trades are usually the most advantageous.

[1] How big could the losses be? As the yields on bonds fall, so the duration rises. The higher the duration, the higher the price sensitivity to yield changes. We can calculate the likely effect of a 1% rise in bond yields using what is called DV01, or the Dollar Value of a basis point. To do this, we multiply the market value of the bonds by the duration, and then divide that number by 100 (since duration measures the price change for a 100 bp move in yields). For example, the Bank of America global government bond Index has a market value (as of October 2016) of around $25.5 trillion; multiplying that by 8.23, which is the effective duration of the Index, gives you $2.09 trillion, which means a one basis point rise in yields leads to $21 billion in losses (across the whole market). The same calculations can be done on individual bonds, as we discussed here, and here.

[2] The word “implies” is doing a lot of work here – relative yields alone do not constitute sufficient predictive power to justify switching between them, it is but one metric by which investors judge an asset’s attractiveness. Other valuation measures are available…