[Update: in a further sign of the Elite trying to “steer” opinion, the British Chambers of Commerce have announced the suspension of it’s former Director General, John Longworth after he voiced pro Leave views. The Government have denied putting pressure on the BCC to remove him. When an official denies something, it is normally a sign that it is true].

Your imagination is your preview of life’s coming attractions.

So, the starting gun has been fired – in just 111 days, the future of the UK in Europe may (or may not) be decided irrevocably. 111 days may not seem like a long time, but rest assured it will do by day R-50. Markets have already reacted to the prospects of “Brexit” as it is being dubbed, even though the bookies appear to think we will “stay”. “A week is a long time in politics” (if Harold Wilson is to be believed) and there is plenty of time for twists and turns in events. But what are the implications? What are the Stakes ?

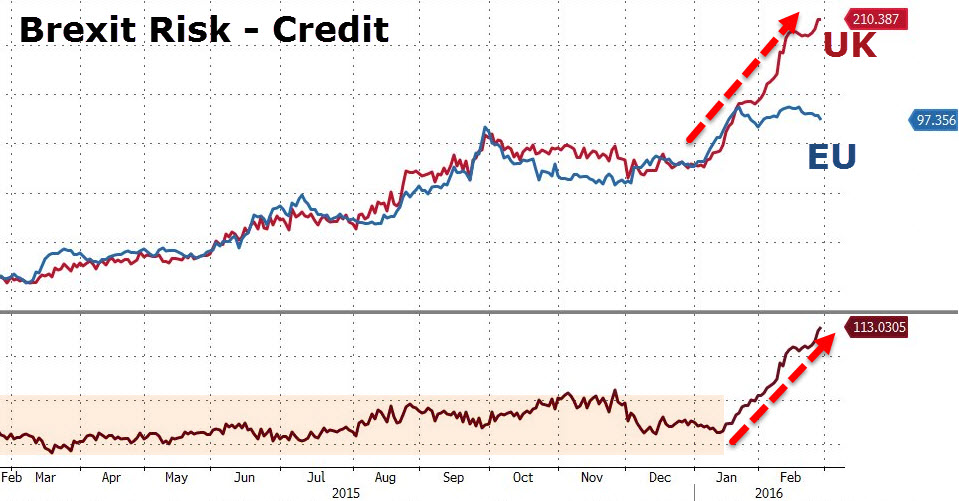

The chart below shows how bond markets have reacted to the EU negotiations and the news of significant disagreements between Conservative Party Ministers on how good the deal Cameron negotiated actually was. The UK has apparently become a risky place to invest. [It implies of course that Britain post- EU membership is actually riskier than the EU itself- given the assorted economic and social problems the continent faces, this seems somewhat dubious. Daniel Hannan describes EU exit as “the alternative to remaining in a structurally unsafe building “, but his view is very much in the minority (in public at least)].

Needless to say, Banks and other Financial Institutions have lined up to explain to a grateful audience how to “play ” Brexit, mostly focussing on Sterling. But as the chart below shows, the damage has already been done. Last week Sterling hit 7 year lows versus the Dollar. It has rallied only 2-3 cents, back to around $1.41 in the last 2-3 days.

In a replay from the Scottish Referendum play book, however, the Establishment have been straight out of the blocks with all kinds of doomsday forecasts resulting from a British OUT vote, (Examples here, here and here ), pointing to risks of job losses, UK recession, London losing it’s pre-eminence in European financial markets and currency collapse-though not yet the mandatory death of one’s first born- all designed to frame the choice in terms of risks, which it is assumed the population (as was the case in Scotland) will not be prepared to take. (Re-assuringly, some of the dire forecasts are from economists , which reduces the likelihood of them occurring dramatically). The European Establishment (1) are also united in wanting Britain to stay, as are Japanese businessmen , US politicians, and even the majority of European people. On the face of it, therefore, the “Out” campaign is up against it.

The implications for the country could be profound: if any of the outcomes predicted above come to pass, the economic effect on all UK citizens will be large and negative. But how likely are they to occur ? To take the above risks, Big Business is always in favour of European integration (they cite the need to maintain “business confidence”, which is a synonym for “do what we want or there will be a crisis” (2); it is clear that In or Out, companies will still invest in the UK, as the time position of the UK (between the US and Europe), the language dominance of English , and flexible labour regulations give the UK a huge advantage over the rest of Europe and will remain the same. HSBC have vacillated over moving their HQ to Hong Kong for years, but finally decided against it only a week or so ago. Now , they say they might move to France – given the 75% personal tax rate which was only recently rescinded by Hollande’s socialist government, they may have trouble finding staff to fill their offices. This sounds like another bluff. The Pound has already fallen sharply with no obviously deleterious effects on the economy; indeed the Bank of England may well welcome a sustained fall in the currency as a boost in the fight against deflation. According to this article, one Bank is forecasting Sterling reaching parity (i.e a 1:1 exchange rate) with the Euro if Brexit occurs. This of course assumes that the Euro will not fall in value in its own terms, which again is an argument of dubious merit. Finally, the (ludicrously precise) chance of a recession quoted by economists may not be seen as credible- most recessions occur at a global level, and have much more to do with demand trends across the world than in one particular region.

Will the population vote according to what the Elites want, or on issues that are less (directly) to do with economics (migration or sovereignty for example). Populist sentiment may be the dominant factor, trumping their wish for “stability” , “confidence” and so on. The tide of anti-establishment feeling is rising, (both here, in Europe and in the US), and it is possible that the electorate may wish to give ALL politicians a bloody nose, regardless of the merits of the “In ” case.

The bigger implications may well be for the politicians- Cameron will be removed if he loses (despite what he says ), (to be replaced by Boris Johnson ?), and it may even hasten the demise of the European Union. Angela Merkel has been weakened by the refugee crisis, and François Hollande’s poll rating is way behind that of Marine Le Pen, at least for the first round of voting. By June, the ECB may have failed (again) to re-start growth, pushed Interest even further negative and refugees may be flowing freely through Europe once again. Under those circumstances, ” the tectonic plates of European politics are picking up speed and decades of non-reform and non-compliance are coming back with interest on top” (4) according to one economist. Maybe that is why European politicians are queueing up to propose that we stay.

As to the stakes involved, the matter is far more nuanced than we are being led to believe. The sheer scale of the claims and counter-claims on both sides hint at the degree of uncertainty involved ( what sort of trade deals would we get with the EU, to what extent does trade itself benefit the economy and how long would the costs/savings take to actually arrive ?). This paper suggests that it is almost impossible to introduce policies to make much of a difference to an OECD country’s long run economic growth rate in any event, and even when successfully implemented, have long and variable lags before they have any effect. A “Brexit Report” commissioned by the Fund Manager Neil Woodford (3) came to the conclusion on Brexit that “we doubt that Britain’s long-term economic outlook hinges on it. Things have changed a lot since 1973, when joining the European Economic Community was a big deal for the United Kingdom. There are arguably much more important issues now, such as whether productivity will recover”.

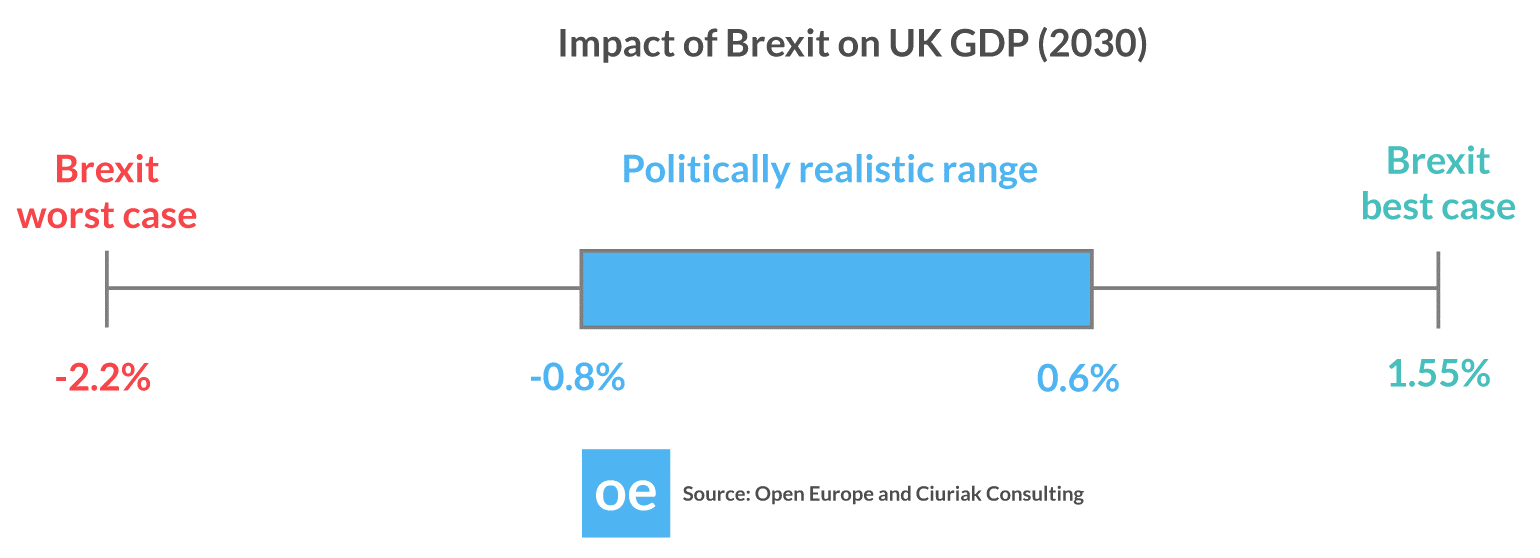

The chart below suggests a 3.75% range in the outcome for UK GDP over 12 years (assuming a Brexit completion in 2018). It is highly debatable whether anyone would notice an effect of between +0.6/-0.8% over that period.

It is to be hoped that the constant scare tactics currently being employed by a seemingly desperate elite will be ignored. It is to be feared that people will be scared into voting “Yes” to the EU in an attempt to keep their jobs. [The best reason to hope for an “Out” vote is to watch politicians, business, the Media and economists explaining why they got it wrong- just dont expect any contrition from any of them].

Ultimately, it may come down to how people are feeling rather than what they are thinking. Thus, the outcome is impossible to predict: if we cannot discern the outcome of the election, the reaction of markets is even more problematic. A view on the result would probably be best informed by a judgement on the inherent conservatism of voters- are they angry enough to vote leave, or will they pause at the ballot box and consider the “risks” ?

We at EBI will NOT be losing sleep over the result; An outcome that is unpredictable cannot be hedged. Global trends will have a much greater effect than a Referendum result either way. If Sterling falls as a result of a decision to leave the EU, it will improve overseas market returns when re-priced back into Pounds, and bolster the idea that Global Portfolios are a better long term strategy than owning a UK-biased one. We just hope we can contain ourselves as the excitement mounts in the run-up to June. The long evenings will just fly by…

(1) Deutsche Banks’ Jim Reid has a potential way out for those Europeans desperate for the UK to stay in- “Thinking about it, if our European friends really want the UK to stay maybe they should let us win Eurovision this year and let us have a good start to Euro 2016. Maybe PM Cameron didn’t dare hold the referendum any later than June 23rd as the UK home nations might not be in the tournament much past this date (final on July 10th) with the usual associated doom surrounding our exits”. (via Zero Hedge) .

(2) “Under a laissez-faire system the level of employment depends to a great extent on the so-called state of confidence. If this deteriorates, private investment declines, which results in a fall of output and employment (both directly and through the secondary effect of the fall in incomes upon consumption and investment). This gives the capitalists a powerful indirect control over government policy: everything which may shake the state of confidence must be carefully avoided because it would cause an economic crisis”. Michal Kalecki, Political Aspects of Full Employment, http://mrzine.monthlyreview.org/2010/kalecki220510.html

(3) The Economic Impact of “Brexit” – Capital Economics, Feb 2016.

(4) Steen Jakobsen, Chief Economist, Saxo Bank, www.tradingfloor.com