Technology stocks are the top dogs of the stock market. For the last 6 months or so, they have risen almost without a pause and have become a greater and greater influence on the direction of the overall stock market. Last month, the big four MAGA stocks (Microsoft, Amazon, Google (Alphabet) and Apple) reached the point where they represented over 17% of the total S&P 500, and contributed almost 70% of the gains attributable to that Index in 2020 alone.

How did they get this big and thus so influential on both the stock market and the wider economy? There was of course a lot of hard work, plus some innovative ideas, but they had a few advantages that were (mostly) unavailable to other firms. If you want to become a “tech titan”, some or all of the following tailwinds need to be behind you.

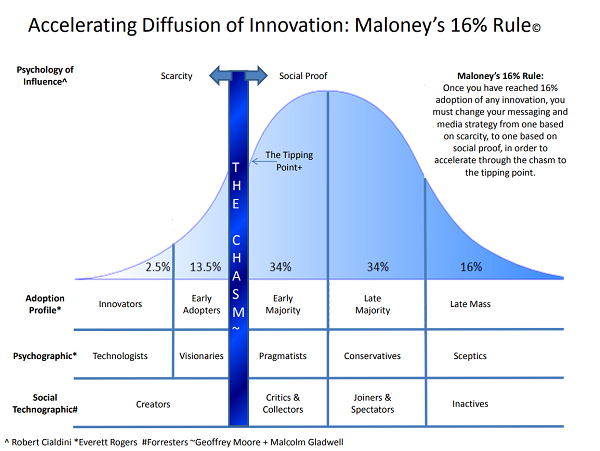

1) Very low and stable interest rates: since the 2007-09 financial crisis (but in fact post 2002), Central banks have been desperate to keep economic growth going, using Forward Guidance (essentially promising not to raise rates for a long time – if ever) and introduced large scale asset purchases, new liquidity injections etc. to drive home the point to investors. This allowed new start-ups to be valued at higher than expected levels (as the Discount rate – the process whereby investors value the future stream if earnings deliverable to investors over time fell – The Time Value of Money theorem). In turn, this allowed losses to be ignored in favour of the profits to be gained at some point in the future. Loss-making enterprises were given the benefit of the doubt as yield and return starved investors looked into the future, rather than the present. To justify the lofty valuations, money was spent on marketing campaigns, with rebates and incentives for new customers to spark consumer interest in an attempt to cross the 16% “chasm” (described below), whereby the critical adoption threshold for one’s product is reached, a subject we touched on back in August 2018.

2) Lower cost employees: the more one pays one’s employees in shares (rather than cash), the cheaper they become. Cashflow improves and the firm’s employees are now almost as dependant on the stock markets as their firm for their livelihoods. By some estimates, 50% of the salaries of top level employees of tech firms are stock based, which is a way of deferring what would normally be described as “normal operating expenses”. This gave these firms a huge cost advantage in the race to “disrupt” industry incumbents.

3) Low cost of capital: few technology firms pay dividends and regular share issuance ensures that the cost of equity is very low. Some firms, such as Amazon and Apple have only just started paying dividends at all and yields remain very small. Issuing bonds too is extremely cheap, with the average US Corporate bond yielding just 3%. As with employee costs, issuing deferred bonds (payment in kind, or zero coupon bonds), delays the point at which the liabilities become due.

4) Little or no taxes to pay: aggressive corporate accounting, such as transfer pricing as used by many of the big names (Google, Amazon etc.) has resulted in virtually no taxes being paid at all. In 2018, analysis revealed that 60 of the biggest firms in the world paid no tax in 2018 as a combination of tax credits (for example for R&D expenditures), accumulated losses from previous years and the use of accelerated depreciation schedules [1], removed the need to contribute to tax authorities revenue the world over, despite billions of dollars in real earnings. Last year, the 275 Bay Area tech firms (based and registered in San Francisco), paid an average of 3% of their revenues in taxes. No wonder then, that European countries such as France and the UK are trying to end this practise, but they face strong opposition from the firms themselves as well as the US, in whose nation most of these firms are based, not least from Donald Trump himself.

5) A narrative explaining the new phenomenon: Jim Bianco, Head of Bianco Research, describes Amazon et al as “transformative businesses”, citing Amazon and Google as fomenting “creative destruction” in the retail and newspaper industries. “Legacy businesses need to adapt in a major way or risk becoming taxi drivers in the Uber world”. Talk of new paradigms, mission statements, competitive moats and future monetisation of consumer demand provides a blanket under which investors can snuggle in the face of cash burning, loss making companies. Hope thus springs eternal, and investors are happily paying up for what they see as “growth” shares in a low-growth universe.

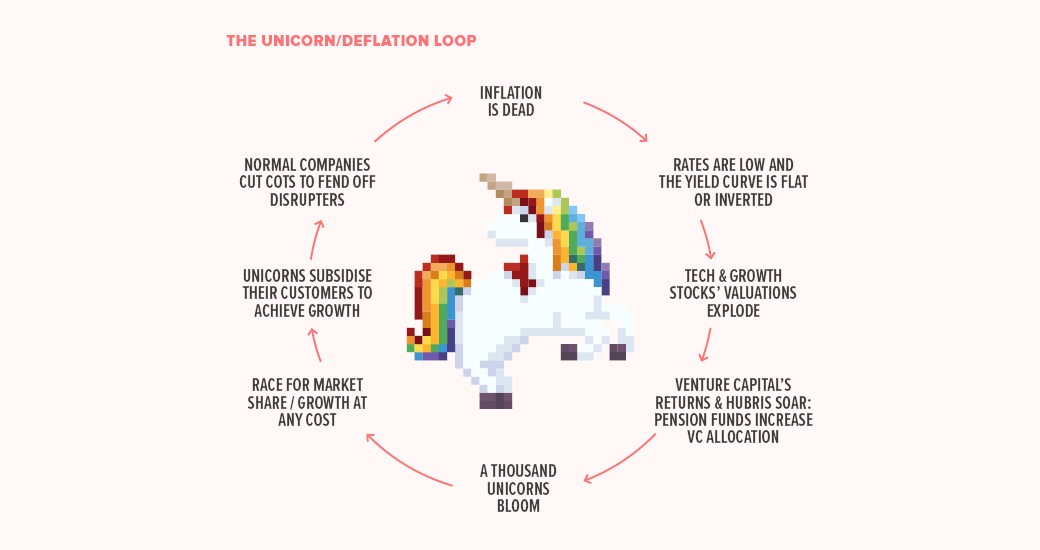

As usual, central banks are important players here too – as the diagram below suggests, in a low interest rate environment a feedback loop is generated, whereby liquidity finds its way to venture capital firms. For example, who fund start-ups in companies dedicated to taking market shares from existing businesses, forcing them to cut costs (job losses etc.). This in turn creates the deflation that inspires further interest rate cuts and liquidity infusions from Jerome Powell, Christine Lagarde and Haruhiko Kuroda amongst others. It is not clear where it ends, but in that scenario, those firms that are growing will always capture investors interest and their investment dollars.

So, the circumstances that they have skilfully taken advantage of have generated significant benefits for this sector, relative to older established businesses, which explains a large part of their (stock market) success. Of course, there are still challenges ahead – Donald Trump has many of them in his sights and at the behest of the President, the Federal Trade Commission is investigating allegations of “unfair trading practises”. In an election year, this is a particularly pertinent issue, overriding even the importance Trump himself places on the performance of the stock market.

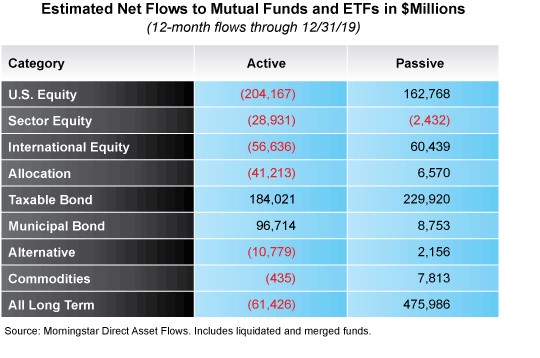

But absent a major shift in both governmental attitude and/or market sentiment, there does not appear to be anything on the horizon to change this situation. The tech juggernaut thus rolls on, confounding both the bears and those not Index invested (a.k.a. Hedge funds). Investors withdrew a net $98 billion from these investments in 2019, the most since 2016, as investors are clearly tiring of the lacklustre performance of these managers. Judging by the continued across the board trend towards passive investing (see chart below) and recent market movements, much of this money is finding its way to tech stocks…

[1] Normally, a company writes off the value of an asset over several years, gradually reducing its value to reflect its declining worth; depreciating its value in one go causes a massive “loss” which can be offset against tax liabilities. Similarly, they are allowed to value stock options (that they have not yet paid out on) as an expense, rather than the true cost at that point (which is zero). Spot the contradiction between this and point 1) above. It is all legal of course, but it means that firms end up paying miniscule taxes on actual, declared earnings.