“If all you’re trying to do is essentially the same thing as your rivals, then it’s unlikely that you’ll be very successful” – Michael Porter.

In the last fortnight, there has been something of a reversal in the market’s favorite Factor trade – long Growth/Momentum and short Value. It began in the US, but as is normally the case, it soon went Global. As a result of this, months of gains in Momentum (long) and Value (short) were lost in a matter of days.

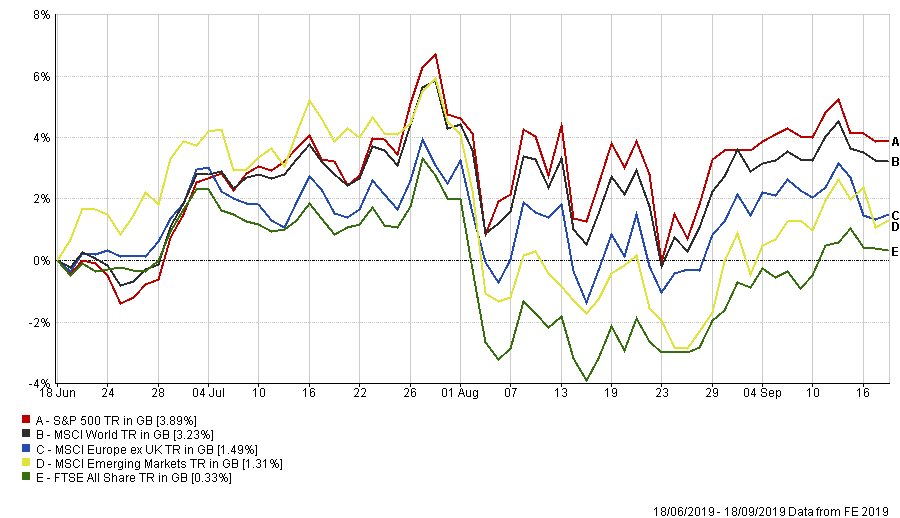

But one would not have known anything of this, looking at the Indices, with all major markets seeing gains since the start of September.

What was the background to all of this mayhem? Investor (Hedge Fund) “crowding” and an institutional consensus market view that the economies of the world are definitely heading for a recession; the latest Bank of America Fund Manager survey (conducted over the period September 6-12th) sees Institutions capitulating on their interest rate forecasts, with just 21% of those asked expecting rate rises in the next 12 months, (compared to 87% from one year ago), with expectations for global EPS growth at -3.1%. So they remain overweight assets that outperform in an era of low inflation and low rates (Growth/Momentum/Quality etc.) and underweight those that might benefit from rising interest rates and earnings (i.e. Value). It appears that few have changed this macro-economic viewpoint, despite the latest Factor performances.

The problem has been compounded by the fact that bond risk embedded in asset portfolios is so widespread. Bond yields have fallen into inversion, whilst equity prices have risen, as it is believed that lower interest rates imply higher equity values [1]. The “risk-off” nature of investor’s positioning (long of Quality, Low Volatility, etc.) are all effectively “bond proxy” investments, as opposed to bank shares, Emerging Markets or even the Japanese equity markets are seen as the opposite (and have been sold/underweighted accordingly). This has been a feature of markets since the imposition of QE in 2007-09.

What was the immediate trigger for the recent reversal? It is not clear, but one possible cause might be the recent rush to issue Corporate bonds – according to the FT, $140 billion in new issuance occurred in the week ending September 6th alone, as firms rushed to take advantage of the historically low borrowing rates on offer. Interestingly, there were none of the “mega-deals” seen in recent times, suggesting a generalised interest in debt issuance/re-structuring. But bond dealers who are participating in the launches of these bonds needed to hedge their interest rate risk by selling equivalent duration Treasury bonds, which, when combined with a large number of long positions in the marketplace, led to bond sales and a rise in bond yields, thereby triggering the factor reversal; of course, this had very little to do with economic fundamentals and did not necessarily indicate a resumption of economic growth in itself [2], but for those on the wrong side of this reversal, this is of little comfort, as those holding momentum shares saw losses escalate quickly, whilst their short exposures, (mainly Value shares) saw sharp rallies.

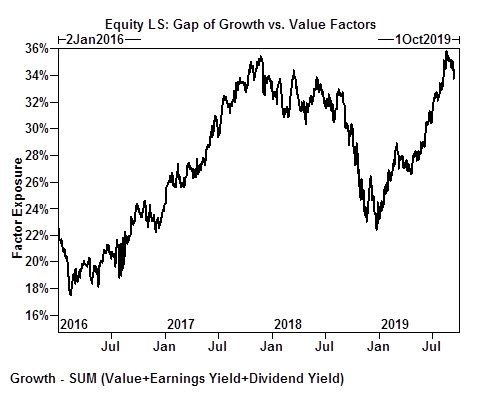

But we need to put this in perspective – the Long Growth, Short Value trade has been a stellar performer, as the chart below demonstrates; a lot of money has changed hands between those holding long Momentum and long Value exposures in recent days but it is more the violence of the move in such a short space of time that is worthy of note.

What this reminds us is the need for genuine portfolio diversification- investors appeared poorly positioned for “positive” news, being crowded into similarly exposed positions, namely bond proxies- those assets whose gains are predicated on further falls in interest rates. Factor investing is inherently cyclical in nature, partly as a result of the make-up of their constituents- Value, for example, has a large exposure to energy and materials shares, which are heavily dependent on overall economic growth. It is by no means certain that economic growth will resume any time soon, but the point of diversifying a portfolio is to hedge this (and other) risk. To do so requires buying into cyclical assets, (which appears to be what has happened in the last week or so), in the US at least, although preferably at the point of portfolio construction, rather than after a Value rally has occurred. Whether Value’s out-performance will continue is unknown and largely irrelevant to the issue at hand. It appears that investors have (until this week), forgotten this diversification principle, for which some are now paying heavily. It may be painful at times to own Value shares, as EBI has discovered in the last 5 years or so, but the alternative is much worse – investing is hard enough without going through the trauma of sharp and rapid losses for which there may not be a readily available explanation. It is this sense of bewilderment that often causes investors to bail out. It is vital to know what one owns, but even more important to know why…

[1] As has been stated before, this is not logically consistent though – IF interest rates fall, does that not have implications for growth, etc.?

[2] In this context, it is worth noting that, for all the hype over yield curve inversions, there may be a circular nature to the logic of market moves – investors/traders, etc. buy bonds, lowering interest rates, thus convincing everyone else that a recession is imminent; as the saying goes, sometimes the map is not the territory…