A robot walks into a bar and takes a seat. The bartender says, “We don’t serve robots.”

The robot replies, “Someday – soon – you will.”

One only has to watch financial TV for a few minutes to hear some pundit or other lower their voice and intone sagely, that “markets hate uncertainty”. But when exactly was anything about markets NOT uncertain? What the speaker is actually saying is that market participants hate losses, (which is why they were so keen to see the Fed bail them out in 2008-09, a habit that both parties have since found hard to break).

What investors have to deal with every day is better described as ambiguity (which is a synonym for, but is not actually, uncertainty per se); in 1962, Stanley Budner, a New York psychologist developed the construct as one of ambiguity tolerance or intolerance, whereby, “Intolerance of ambiguity may be defined as the tendency to perceive (i.e. interpret) ambiguous situations as sources of threat; tolerance of ambiguity as the tendency to perceive ambiguous situations as desirable” [1]. Clearly, some investors can cope with this (perpetual) state of affairs better than others. This was best demonstrated in the Ellsberg Paradox, where it was shown that participants prefer a known probability of winning a bet over an unknown probability, even if the latter odds are better. People tend to go with the “devil they know”, especially if the odds of the unknown wagers are difficult or impossible to calculate.

In investment terms, one of the ways this manifests itself is in “Home Bias”, a preference for investing in assets with which one is familiar; as the (oft used) chart below demonstrates, this has not worked out well, going back as far as 2013, though this is a relative loss, rather than an absolute one (the All Share has returned an annualised 7.08% per annum since 2011, far in excess of inflation).

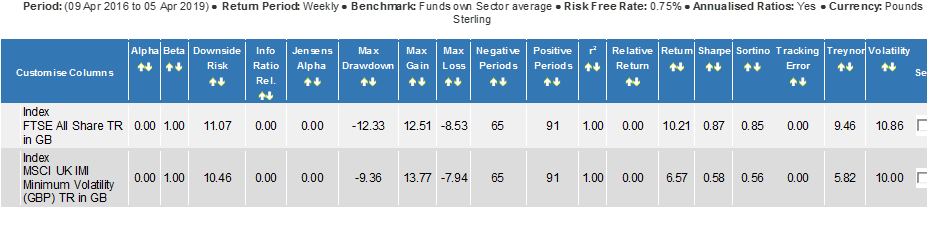

We can also see this in the popularity of “Low Volatility” investing, whereby the fund manager aims to minimise asset price swings. This is assumed to lower “risk”, but as the 3-year table below implies, it has come with another, different, risk – that of underperformance, with no significant reduction in overall Volatility – as a result, the Sharpe Ratio, (a volatility-adjusted return metric), is substantially lower than for the All Share Index itself.

The on-going Brexit drama has prompted some to consider whether the FTSE 100, (which is a far more globally exposed Index than the FTSE 250 for example) might be a better investment than the 250 Index, but again, it implicitly assumes a continued decline in Sterling (as firms with a large overseas revenue stream would benefit for the pound’s decline). But how do we know how Sterling will react to any resolution of the current impasse? Even if we could accurately compute the odds of one scenario or another, it would not tell us much – is a 20% chance of a 30% fall in Sterling high, or low? Goldman Sachs have stated that they believe that the possibility of a US recession in the next year is 10%, but that is essentially meaningless on its own- it depends on how the statement is framed and the context.

Maybe what this shows is that investors are more “loss averse” than “risk averse”. Losses loom larger in investors minds than do gains, resulting in the tendency to sell “winners” too soon and hold on to “losers” for too long. Risk is thus a somewhat subjective term; for investment “professionals” volatility is a synonym for risk, but that is not necessarily the case for investors. For most of them, risk is a loss of capital (either in a fall in asset prices or a loss of purchasing power via inflation depending on the level of equity exposure). Both of these risks can be controlled by a sensible asset allocation policy, but they cannot be eliminated completely, as they are an essential component of expected return calculations.

Our brains are not well suited to making investment decisions – fight or flight works well when faced with a charging rhinoceros but not so well when dealing with a charging bull market. We must learn to become tolerant of ambiguity (uncertainty) as it will always be with us and try to let go of the need to predict the future; the need for certainty is an all-too-human trait but it cannot be achieved. The sooner we learn to cope with this reality, the better investors we will likely become.

[1] Budner, S. (1962). “Intolerance of ambiguity as a personality variable”. Journal of Personality, 30(1), 29–50.