“Consider a turkey that is fed every day. Every single feeding will firm up the bird’s belief that it is the general rule of life to be fed every day by friendly members of the human race “looking out for its best interests,” as a politician would say. On the afternoon of the Wednesday before Thanksgiving, something unexpected will happen to the turkey. It will incur a revision of belief. ― Nassim Nicholas Taleb, The Black Swan: The Impact of the Highly Improbable.

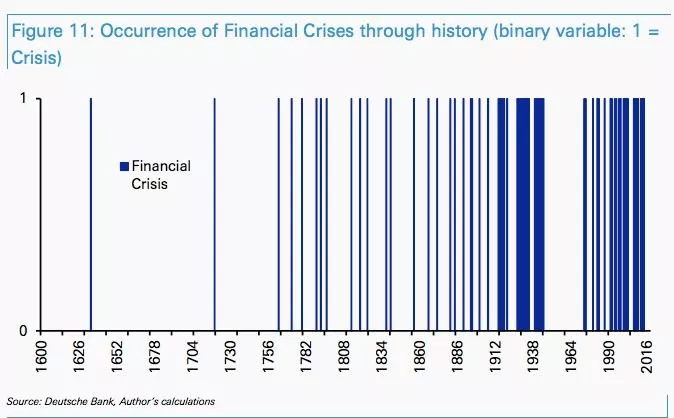

Having relatively little to do at the moment, analysts appear to be playing the spot the “black swan” game, with attention focussed on the likely cause of the next market hyperventilation. A recent Deutsche Bank study suggests that financial crises are occurring with increasing frequency of late, defined by them as a 15% stock market fall, a 10% foreign exchange rate decline a 10% drop in bonds, a 10% rise in inflation or a sovereign default [1].

This, they speculate, is a result of the refusal of the Central Bankers to allow any sort of “purging” of the excesses – leading to a continuous cycle of bubble followed by (mini) crash. They then cite a long list of potential triggers for a collapse, whilst manfully resisting the urge to “collar” one of them as the culprit.

Others have stepped into the void, however – Oaktree Capital, a US Hedge fund believes (citing a recent IMF Global Financial Report), that the next source of trouble will be US Investment Grade debt, as the amount of debt outstanding is very large and of low quality (see chart below). Mutual funds are much more heavily invested therein and at current low rates (and thus high bond durations), will be hit hard as interest rates rise, leading to wholesale contagion across Corporate bonds should a major issuer default, as investors scramble to liquidate. (We wrote about the collapse of Steinhoff bonds late last year, in which even the ECB were caught out); a trickle of credit downgrades, they opine, could turn into a flood once the liquidity tide goes out, as institutions may be much less prepared to “extend and pretend” once stress rises. So far, the plethora of new money coming into High Yield and Leverage loan funds (estimated by Oaktree to be in excess of $150 billion) has kept the potential risks hidden from view, but investors are wont to sell first and ask questions (if at all), much later in the event of price declines.

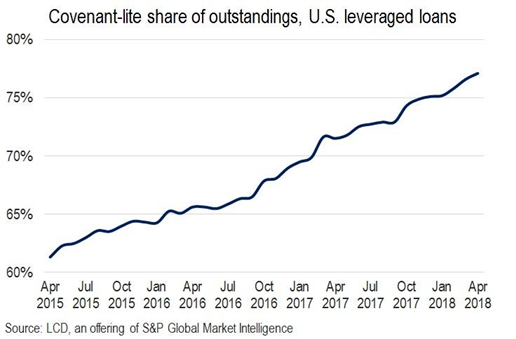

The main concern revolves around “Covenant-Lite” loans [2]. In 2007, 17% of outstanding loans had weaker covenant protection for investors than is standard in the conventional bond documentation. That figure, according to Leveragedloan.com is now over 75% of total outstanding loans. Both Leveraged loan and High yield issuance have nearly doubled since 2007; as investors have become more desperate for yield, firms have had the upper hand in negotiations, allowing them to obtain financing at ever-easier terms. But with the median Corporate credit rating now at BBB – (i.e. one notch above junk), there is not much room for manoeuvre in company financing options in the event of trouble.

As the chart below shows, we are now heading into the peak of debt maturities and as the Fed continues to raise rates, something somewhere has to give. If it does, it will be the weakest links in the chain that fail first and that would be the Speculative (i.e. High Yield) sector.

The recent price falls seen in Turkey, Argentina, India and so on (which we covered last week), may be a sign of the process getting started in earnest (as they are amongst the links referred to above).

.png)

But maybe not JUST yet – according to Bloomberg, the number of “Fallen Angels” [3] as of the end of April 2018 was just 45, with a combined debt of “just” $119 billion. The higher US Interest Rates go, the more that number will increase. The key issue is the recovery rate (the percentage of the debt that is actually re-paid in the event of default). Moodys Ratings Agency has (as of May 2017), forecasted a fall in recovery rates from the long-term average of 85% down to just over 60% (i.e. a 40% loss) as both absolute debt levels and the prevalence of Covenant-Lite loans increases investment risks.

For now, interest coverage ratios are still healthy, especially in comparison to those pertaining in 2007, but if the firms have NOT hedged via Interest Rate Swaps, the pressure will already be rising. The problem only really becomes intense when these bonds mature and the company concerned needs to refinance the loan.

How can investors avoid this minefield? One can move to cash, switch to lower duration bonds or invest in less risky sectors (out of the oil, or retail industries for example), but the best strategy is to not be invested in this area at all. It seems imprudent to be investing in this arena in any event – if one is bullish on the firm’s survival, why not just buy the equity? A High Yield bond has similar characteristics to that of equities, but a finite up-side (the yield to maturity); in addition, given that it has a definitive maturity date, it can even be riskier in certain circumstances as there may not be enough time for the firm to work its way out of short-term difficulties before the bond is re-payable – thus the investor could lose a large proportion of their money simply through the bad luck of having their bond mature just when the crisis is at its worst. If the company (and thus the share price) recovers, the investor will not see the benefits.

EBI Portfolios has virtually no exposure to low rated credit – the average Credit Quality of the Bond portfolio is A, with the lowest rating being BBB-over 50% of the portfolio is rated AA or higher. This does not guarantee avoiding a credit “issue”, but it certainly reduces the odds. As we have said before, bonds are not (in our world) a source of returns anyway, but a means to dampen the volatility associated with equity ownership. All that high yield bonds do is to increase the risks of loss with little or no diversification benefits attached to them. So far, there has been no spillover from the problems being experienced in Emerging Markets debt – but that may change with little or no warning.

[1] A mere glance at the share price of Deutsche Bank confirms this; they appear to understand this process; they appear to be experiencing a crisis all of their own.

[2] Bond Covenants are intended to protect the investor by enshrining in the legally binding agreement between them and the issuer the rights of both parties to not be disadvantaged by the actions of the other. A Covenant-lite loan is one where bondholders rights are reduced, such that the Company can engage in actions that may harm the bondholder’s interests, by, for example, issuing new bonds that have a higher priority in the corporate liability structure, or allowing them to increase overall corporate gearing, thereby making the bonds riskier.

[3] A “Fallen Angel” is a company whose Investment Grade rating has been downgraded to Junk (below BB), an indication of financial stress.